All Categories

Featured

Table of Contents

Trustees can be family participants, trusted individuals, or monetary establishments, depending on your preferences and the complexity of the depend on. The objective is to make sure that the trust is well-funded to fulfill the child's long-lasting financial requirements.

The role of a in a child assistance depend on can not be understated. The trustee is the individual or organization in charge of managing the count on's properties and making sure that funds are distributed according to the terms of the count on arrangement. This consists of seeing to it that funds are made use of entirely for the kid's benefit whether that's for education and learning, medical care, or everyday expenditures.

They must also give routine reports to the court, the custodial parent, or both, depending upon the regards to the depend on. This liability makes sure that the trust fund is being taken care of in a manner that benefits the child, stopping misuse of the funds. The trustee likewise has a fiduciary task, meaning they are legally obligated to act in the very best passion of the youngster.

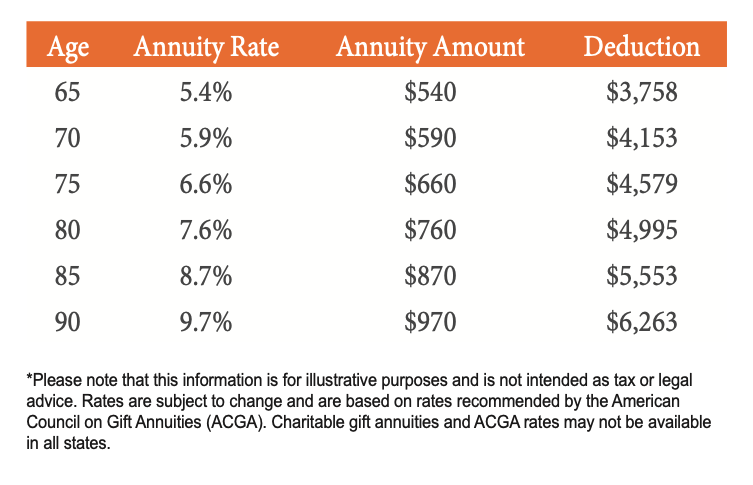

By purchasing an annuity, moms and dads can ensure that a dealt with quantity is paid consistently, despite any fluctuations in their revenue. This offers assurance, recognizing that the youngster's demands will certainly remain to be fulfilled, despite the economic conditions. One of the key advantages of using annuities for kid assistance is that they can bypass the probate process.

What are the tax implications of an Annuity Payout Options?

Annuities can also offer protection from market changes, guaranteeing that the child's financial backing remains stable even in volatile financial conditions. Annuities for Child Support: An Organized Service When setting up, it's important to take into consideration the tax obligation effects for both the paying parent and the youngster. Trust funds, depending upon their structure, can have various tax therapies.

While annuities offer a steady earnings stream, it's important to comprehend just how that revenue will certainly be exhausted. Depending on the structure of the annuity, repayments to the custodial parent or kid may be considered taxed earnings.

One of one of the most substantial benefits of utilizing is the capability to protect a youngster's monetary future. Counts on, specifically, provide a level of security from lenders and can make certain that funds are utilized responsibly. A count on can be structured to make certain that funds are just utilized for specific functions, such as education and learning or health care, protecting against misuse.

How do I apply for an Secure Annuities?

No, a Texas kid support trust fund is especially developed to cover the kid's crucial requirements, such as education and learning, medical care, and everyday living expenditures. The trustee is lawfully obligated to ensure that the funds are made use of entirely for the advantage of the child as outlined in the count on arrangement. An annuity gives structured, foreseeable payments gradually, ensuring consistent economic assistance for the child.

Yes, both youngster support counts on and annuities come with possible tax effects. Depend on earnings may be taxed, and annuity payments might additionally be subject to tax obligations, depending on their framework. Since many senior citizens have been able to save up a nest egg for their retirement years, they are commonly targeted with fraudulence in a method that younger people with no savings are not.

In this atmosphere, consumers need to equip themselves with info to protect their interests. The Lawyer General offers the following pointers to take into consideration prior to buying an annuity: Annuities are challenging investments. Some bear facility top qualities of both insurance coverage and safety and securities products. Annuities can be structured as variable annuities, dealt with annuities, prompt annuities, deferred annuities, and so on.

Customers should read and comprehend the prospectus, and the volatility of each financial investment noted in the syllabus. Financiers should ask their broker to clarify all terms and conditions in the prospectus, and ask questions concerning anything they do not comprehend. Fixed annuity products might also bring threats, such as lasting deferment durations, barring investors from accessing all of their money.

The Attorney general of the United States has filed legal actions versus insurance provider that sold unsuitable delayed annuities with over 15 year deferment periods to capitalists not expected to live that long, or that need accessibility to their money for health and wellness care or helped living expenditures (Annuity withdrawal options). Investors must see to it they understand the lasting effects of any kind of annuity purchase

Who has the best customer service for Deferred Annuities?

The most substantial cost linked with annuities is commonly the surrender fee. This is the percentage that a customer is charged if he or she takes out funds early.

Customers may wish to consult a tax obligation expert prior to investing in an annuity. The "safety and security" of the financial investment depends on the annuity.

Representatives and insurance business may use perks to tempt investors, such as extra rate of interest points on their return. Some unscrupulous representatives motivate customers to make unrealistic investments they can't afford, or get a lasting deferred annuity, even though they will need accessibility to their cash for wellness treatment or living expenses.

This section provides details beneficial to retired people and their family members. There are several celebrations that might influence your benefits.

Is there a budget-friendly Immediate Annuities option?

Secret Takeaways The beneficiary of an annuity is an individual or company the annuity's owner assigns to obtain the agreement's survivor benefit. Various annuities pay out to beneficiaries in different ways. Some annuities might pay the beneficiary stable repayments after the contract holder's death, while various other annuities may pay a death benefit as a lump sum.

Table of Contents

Latest Posts

How much does an Annuity Withdrawal Options pay annually?

Are Retirement Annuities a safe investment?

What is the process for withdrawing from an Flexible Premium Annuities?

More

Latest Posts

How much does an Annuity Withdrawal Options pay annually?

Are Retirement Annuities a safe investment?

What is the process for withdrawing from an Flexible Premium Annuities?