All Categories

Featured

Table of Contents

Many contracts permit withdrawals listed below a specified level (e.g., 10% of the account worth) on an annual basis without abandonment fee. Money surrenders might undergo a six-month deferment. Variable annuities. Build-up annuities typically attend to a money payment in case of death prior to annuitization. In New York, death advantages are not dealt with as surrenders and, because of this, are exempt to surrender fees.

The contract may have a specified annuitization day (maturation date), yet will typically enable annuitization at any moment after the very first year. Annuity revenue alternatives listed for instant annuities are normally also readily available under deferred annuity agreements. With a build-up annuity, the contract owner is said to annuitize his or her buildup account.

Why is an Fixed Indexed Annuities important for my financial security?

You can make a partial withdrawal if you require extra funds. In enhancement, your account value continues to be maintained and attributed with current passion or investment incomes. Certainly, by taking periodic or systematic withdrawals you risk of diminishing your account value and outlasting the agreement's accumulated funds.

:max_bytes(150000):strip_icc()/Secondary-Market-Annuity.asp-Final-1ca20750b00e46cd955fba96155eeb3a.png)

In a lot of contracts, the minimal rate of interest is established at issue, but some contracts allow the minimum rate to be changed regularly. Excess rate of interest contracts provide adaptability with respect to costs repayments (solitary or flexible) (Fixed annuities). For excess passion annuities, the optimum withdrawal charge (also called a surrender charge) is covered at 10%

A market price modification changes an agreement's account worth on abandonment or withdrawal to reflect changes in rate of interest given that the invoice of contract funds and the remaining duration of the rate of interest price assurance. The change can be favorable or unfavorable. Retirement income from annuities. For MGAs, the maximum withdrawal/surrender fees are mirrored in the following table: Year 1Year 2Year 3Year 4Year 5Year 6Year 7Year 8 and Later7%6%5%4%3%2%1%0%Like a deposit slip, at the expiration of the warranty, the buildup quantity can be renewed at the firm's new MGA price

How much does an Guaranteed Return Annuities pay annually?

Unlike excess rate of interest annuities, the amount of excess rate of interest to be credited is not understood till the end of the year and there are generally no partial credit reports during the year. The method for figuring out the excess interest under an EIA is figured out in breakthrough. For an EIA, it is important that you know the indexing attributes made use of to figure out such excess passion.

You should also know that the minimal flooring for an EIA differs from the minimal flooring for an excess interest annuity. In an EIA, the flooring is based upon an account value that may attribute a lower minimum interest rate and may not attribute excess interest every year. On top of that, the optimum withdrawal/surrender fees for an EIA are set forth in the following table: Year 1Year 2Year 3Year 4Year 5Year 6Year 7Year 8Year 9Year 10Year 11 and Later10%10%10%9%8%7%6%5%4%3%0% A non-guaranteed index annuity, additionally frequently referred to as an organized annuity, signed up index linked annuity (RILA), buffer annuity or flooring annuity, is a build-up annuity in which the account value boosts or reduces as determined by a formula based upon an external index, such as the S&P 500.

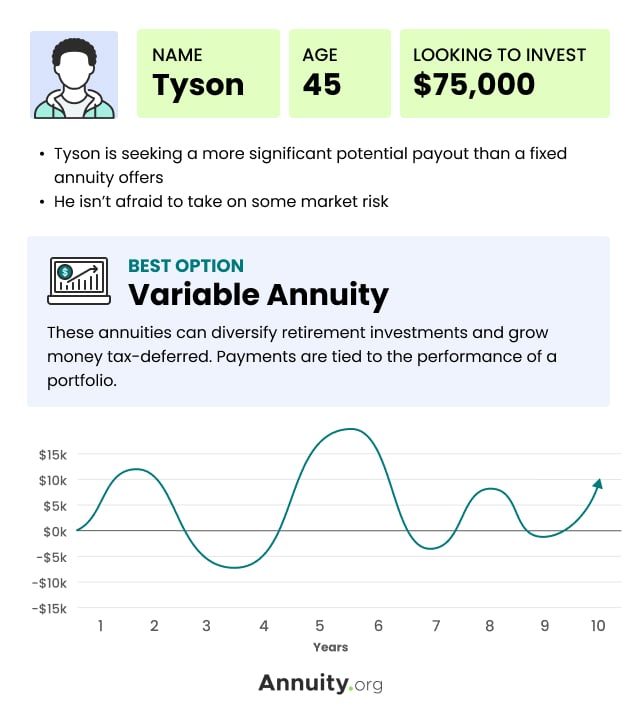

The allocation of the amounts paid into the agreement is typically elected by the owner and might be transformed by the owner, based on any legal transfer limitations (Immediate annuities). The complying with are crucial attributes of and factors to consider in purchasing variable annuities: The contract holder births the financial investment danger connected with possessions held in a different account (or sub account)

Withdrawals from a variable annuity may undergo a withdrawal/surrender cost. You need to recognize the size of the fee and the length of the surrender fee duration. Starting with annuities offered in 2024, the maximum withdrawal/surrender fees for variable annuities are stated in the following table: Year 1Year 2Year 3Year 4Year 5Year 6Year 7Year 8 and Later8%8%7%6%5%4%3%0%Demand a duplicate of the program.

What is the difference between an Annuity Investment and other retirement accounts?

The majority of variable annuities include a survivor benefit equivalent to the better of the account value, the costs paid or the highest possible anniversary account value. Many variable annuity contracts offer assured living advantages that provide a guaranteed minimum account, revenue or withdrawal advantage. For variable annuities with such ensured advantages, customers must understand the charges for such advantage guarantees as well as any constraint or limitation on financial investments options and transfer civil liberties.

For repaired postponed annuities, the bonus rate is included in the interest rate stated for the initial agreement year. Know how much time the bonus price will certainly be attributed, the rates of interest to be credited after such reward price duration and any kind of additional costs attributable to such benefit, such as any greater surrender or mortality and expenditure fees, a longer abandonment charge period, or if it is a variable annuity, it might have a benefit regain charge upon death of the annuitant.

In New York, representatives are needed to supply you with comparison kinds to help you decide whether the replacement is in your best interest. Be mindful of the effects of substitute (new surrender cost and contestability period) and make certain that the brand-new product matches your current demands. Watch out for replacing a postponed annuity that might be annuitized with an instant annuity without contrasting the annuity repayments of both, and of replacing an existing contract entirely to receive an incentive on one more item.

Income taxes on passion and financial investment incomes in postponed annuities are deferred. Nonetheless, generally, a partial withdrawal or surrender from an annuity prior to the proprietor gets to age 59 goes through a 10% tax penalty. Unique treatment needs to be absorbed roll-over scenarios to stay clear of a taxable occasion. Annuity products have actually ended up being progressively complicated.

How does an Lifetime Income Annuities help with retirement planning?

Usually, claims under a variable annuity contract would certainly be pleased out of such separate account possessions. See to it that the agreement you pick is appropriate for your situations. If you buy a tax obligation qualified annuity, minimum distributions from the agreement are required when you get to age 73. You should understand the impact of minimum distribution withdrawals on the warranties and advantages under the agreement.

Only purchase annuity products that match your requirements and goals which are proper for your economic and household situations. Ensure that the representative or broker is accredited in great standing with the New York State Division of Financial Providers. The Division of Financial Services has actually embraced guidelines calling for agents and brokers to act in your best interests when making referrals to you related to the sale of life insurance policy and annuity products.

Be wary of a representative that recommends that you authorize an application outside New york city to buy a non-New York product. Annuity items accepted for sale in New York generally give better consumer securities than items offered elsewhere. The minimum account values are greater, costs are reduced, and annuity settlements and death advantages are more favorable.

Why is an Retirement Income From Annuities important for my financial security?

While doing so, that growth can potentially experience growth of its own, with the gains intensifying gradually. The opportunity to achieve tax-deferred growth can make a considerable difference in your earnings in retired life. As an example, a $100,000 acquisition repayment worsened at a 5% price annually for twenty years would certainly expand to $265,330.

Table of Contents

Latest Posts

How much does an Annuity Withdrawal Options pay annually?

Are Retirement Annuities a safe investment?

What is the process for withdrawing from an Flexible Premium Annuities?

More

Latest Posts

How much does an Annuity Withdrawal Options pay annually?

Are Retirement Annuities a safe investment?

What is the process for withdrawing from an Flexible Premium Annuities?